We have many successful client engagements which demonstrate the breadth and depth of our capabilities. While our recommendations may vary by client, our approach is always the same. We conduct a complete and objective diagnostic analysis of the client’s existing situation and compare that to their stated objectives. Then we develop options (based on their decision criteria) which will fulfill their objectives and tolerances.

Success Story # 1 – Private Equity Firm

EBG works with a significant number of Private Equity Firms. One of those firms contacted us after receiving a significant increase in their Group LTD renewal.

The firm indicated that they wanted to reevaluate their overall approach to providing disability protection to their employees. Their objectives were:

- Reduce total employer (ER) spend

- Align their ER provided benefit with Industry Benchmark levels

- Provide their highest paid employees (EE’s) with high quality coverage up to the benchmark norm but then to give them the ability to participate in the decisions and the cost of benefits above benchmark norm.

- They wanted to make sure that any reductions in benefit to the Group LTD plan would not result in an EE’s permanent loss of protection due to their inability to replace that coverage because of a medical underwriting concern.

After analyzing their census and coverage levels along with their Group LTD contract, we discovered the following:

- Their LTD coverage dramatically exceeded benchmark norms for both it’s maximum monthly benefit AND the definition of covered pay.

- Their LTD coverage had contractual language that was inappropriate for high earning white collar occupations.

We showed the client that – while the optics of their plan was very attractive (with high caps which covered total compensation), the underlying coverage was contractually inferior and left them exposed after the 24th month of a claim.

What did they do?

- The firm lowered their Group LTD benefit level to benchmark norms AND they corrected the contractual deficiency at the same time.

- This resulted in a 68% savings in their LTD spend (a significant number).

- For the highly paid EE’s who lost a portion of their ER paid LTD benefit, we provided them with the ability to replace that lost coverage with personally owned Individual Disability Insurance (IDI) with no medical underwriting. The IDI coverage included the following advantages:

- Guaranteed Standard Issue (no medical underwriting)

- Deeply discounted premiums

- Permanent and portable coverage

Final Results – In addition to the immediate savings, the change provided these improvements:

- Increased the efficiency of their overall disability benefit plan by cost shifting and waste reduction.

- Allows those who want the high limit benefit to purchase it at their own expense

- 28% of the highly paid EE’s who lost some of their ER paid coverage, bought the IDI

- Removes excess coverage (waste) on those who did not appreciate or need the higher benefit

- 72% of the highly paid EE’s did not buy the IDI product – that premium was expensive and inefficient

- Allows those who want the high limit benefit to purchase it at their own expense

- Increased LTD rate stability

- The group LTD plan becomes more marketable

- Lower risk profile attracts more carriers to compete for the business and the rates become more stable

- Removed high level risk from the group LTD plan thus lowering the risk of large claims in the future.

- The group LTD plan becomes more marketable

- Value Added – IDI is attractive to high income earners thus creating an executive perquisite

Success Story # 2 – Property and Casualty Insurance Carrier

In the insurance industry, seasoned executive leadership is one of the most important components of an insurance carrier’s enterprise value. Retaining and rewarding that talent in a meaningful way can be difficult and expensive. EBG has a number of insurance carrier clients and so we understand the challenges of the industry and the variable nature of their executives’ compensation.

One large insurance carrier wanted to put together a benefit program for their to 30 executives that the executives would appreciate and value. The budget for the entire project was $100,000 ($3,300/exec) annually. The average income per exec was significant so providing something meaningful to this group for less than $3,500/person/year was a challenge. The optics of this benefit had to be significant.

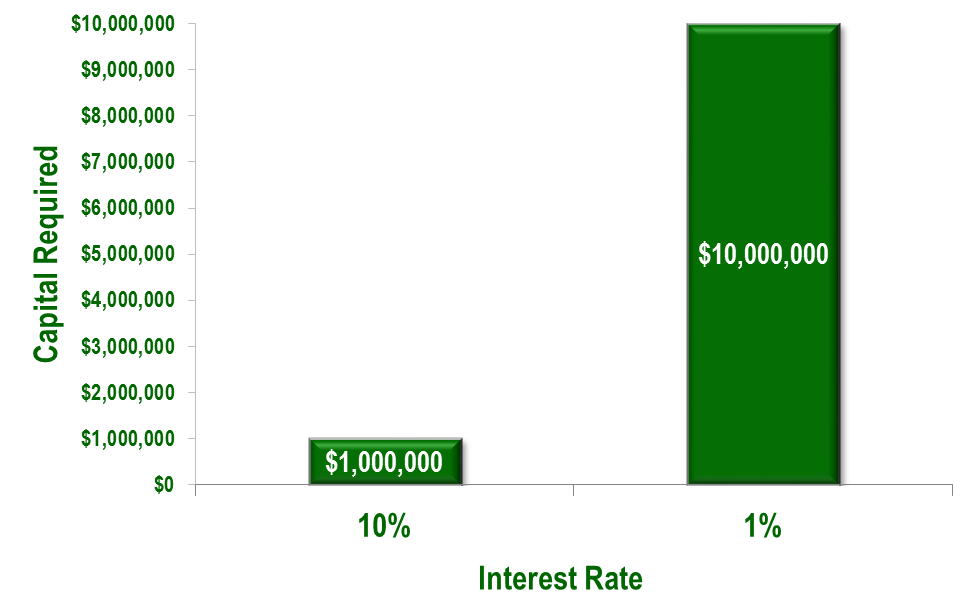

We analyzed the current environment that insurance executives operate in and recognized that a central component was the relationship between a guaranteed stream of income and interest rates. In a declining interest rate environment, the relative value of an annual stream of income increases. Insurance executives understand this concept and truly value income protection.

Example: In the chart below, a $100,000 annual stream of income can be generated by an asset base of $1,000,000 in a 10% interest rate environment however it would require $10,000,000 if interest rates fell to 1%. In today’s extended low interest rate environment, income protection is critical.

The solution

- We recommended a supplemental ER paid individual disability insurance policy for each executive.

- The average cost for the plan was $2,400 / year / executive.

- We developed a creative and customized communication campaign – positioning the benefit as an asset.

The result

- The plan was very well received by the executives and dramatically exceeded the company’s expectations.

- Most of the executives asked if they could purchase additional coverage at their own expense.

- The plan came in under budget and provided a unique value relative to any other options considered.

Success Story # 3 – Large Specialty Hospital

EBG works extensively with non-profit hospitals and universities. One of the challenges they face in recruiting and retaining high quality executive talent is the inability to provide equity in the form of company stock. Often times the solution is to provide an enhanced executive benefits package that is superior to those seen in the corporate sector.

One of our hospital clients wanted to provide an enhanced disability benefit to their executive team with extremely high limits, and very rich benefits. As many on their leadership team were physicians, the value placed on income protection with carefully crafted contractual language was uniquely high.

Their objectives were:

- Increase the benefit level on their top 70 employees.

- Provide disability protection with “physician specific definitions of disability” in the contracts.

- Minimize the increase in total spend to accomplish this enhancement.

- Ensure that every executive could secure the coverage without medical exams.

After analyzing their census and coverage levels along with their Group LTD contract, we discovered the following:

- Providing this increased level of disability protection through their group LTD plan was inefficient. It required an increase in the rate on all of their 10,000 employees (even though most of them did not earn enough to be affected by the increased cap). This increased cost was not the most cost effective solution available.

- It was also determined that providing for this coverage entirely through the group plan was unattractive to the physicians who preferred better contractual definitions than are available in a group LTD plan product.

What did they do?

- The hospital carved out their leadership team into a separate specialty group LTD plan with extremely high limits and very strong contractual definitions (for a Group plan).

- The specialty group LTD limits were still not high enough to cover all of their incomes; therefore to cover the excess, they also implemented an employer paid supplemental disability program funded with individual disability insurance (IDI) policies to sit on top of the group LTD.

- The IDI policies had physician specific definitions of disability and were issued without requiring medical examinations.

Final Results – The hospital now has a “gold standard” disability benefit package for their executives and physician department heads. In addition to increasing their coverage limits, they also:

- Increased the efficiency of their overall disability benefit plan by addressing the high benefit / high risk coverage separately from their core plan.

- Provided a very attractive recruiting and retention tool for their leadership team.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Neither Kestra IS nor Kestra AS are affiliated with Executive Benefits Group, Inc., nor any other entity referenced herein. Neither Kestra IS nor its affiliates provide legal or tax advice and are not Certified Public Accounting firms.

Investor Disclosures https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representatives of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services referenced on this site are available in every state and through every representative or advisor listed. For additional information, please contact our Compliance department at 844-5-KESTRA (844-553-7872).

The above links are provided for your information only. As they are provided by third parties, Kestra Investment Services, LLC does not endorse, nor accept any responsibility for the content. Kestra IS does not independently verify this information, nor do we guarantee its accuracy or completeness.