Disability

For most working individuals, their ability to earn an income is their most valuable asset. Without an income…- How would you pay your bills?

- How would you maintain your lifestyle?

- What would happen to your retirement savings and other important financial goals?

Chances of a Disability

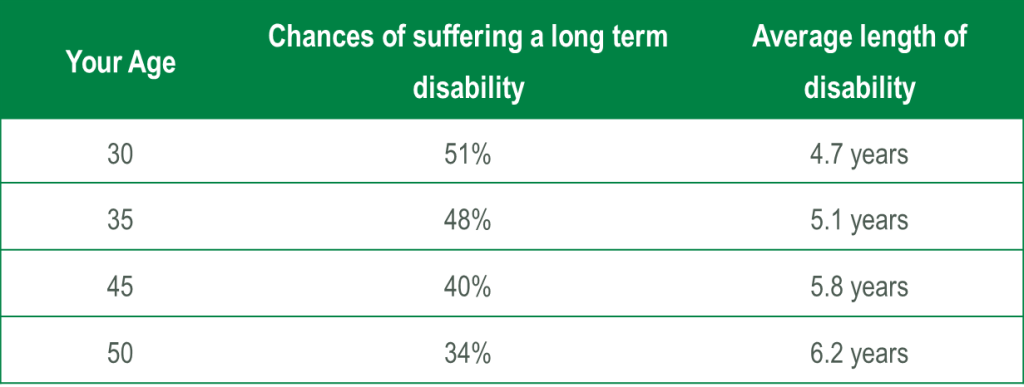

As you can see from this chart however the chances of suffering a disability are right around 45% for most working Americans. Furthermore, the average duration of a disability is not a permanent event. It typically lasts around 5 years. So the question that needs to be asked is: how do you manage your life during that time period from when you are disabled to when you return to work? Group Long Term Disability Employer sponsored Group Long Term Disability (LTD) provides a good base for most individuals however there are several consideration for those planning to use it as there sole means of disability protection.

So the question that needs to be asked is: how do you manage your life during that time period from when you are disabled to when you return to work? Group Long Term Disability Employer sponsored Group Long Term Disability (LTD) provides a good base for most individuals however there are several consideration for those planning to use it as there sole means of disability protection.- Caps on LTD Benefits may be too low for higher paid executives (Reverse Discrimination)

- Policy is not permanent – Benefits and premiums can be modified at renewal

- Policy is not portable

- Benefits typically offset with Social Security

- Group LTD Definitions are limited

- Preexisting Condition limitation

- Variable Compensation is not often times not covered

- Benefits can be taxable when received

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Neither Kestra IS nor Kestra AS are affiliated with Executive Benefits Group, Inc., nor any other entity referenced herein. Neither Kestra IS nor its affiliates provide legal or tax advice and are not Certified Public Accounting firms.

Investor Disclosures https://www.kestrafinancial.com/disclosures

This site is published for residents of the United States only. Registered Representatives of Kestra Investment Services, LLC and Investment Advisor Representatives of Kestra Advisory Services, LLC, may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed. Not all of the products and services referenced on this site are available in every state and through every representative or advisor listed. For additional information, please contact our Compliance department at 844-5-KESTRA (844-553-7872).

The above links are provided for your information only. As they are provided by third parties, Kestra Investment Services, LLC does not endorse, nor accept any responsibility for the content. Kestra IS does not independently verify this information, nor do we guarantee its accuracy or completeness.